Disaster Relief

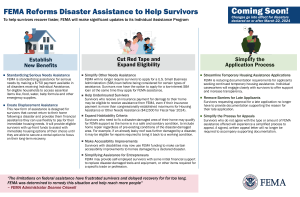

Community Legal Services helps people affected by disasters by providing free disaster recovery legal services and assistance in identifying other available aid resources. For these purposes, a declared disaster requires that an emergency and major disaster declaration has been made in order to activate FEMA service availability.

This statute states in part that FEMA services are only activated where a statewide or locality-specific emergency and major disaster has occurred and the President of the United States declares that a disaster exists. The President is the only person who can officially declare a disaster. They usually declare a disaster after the state’s Governor requests it. CLS is a part of a larger network of public interest law firms helping to solve legal issues for survivors of hurricanes. People often still need legal help long after the storms are gone.

Immediately after a declared disaster, from one day to several weeks, you may need help keeping yourself safe and out of danger. You may need help tending to immediate medical, physical, and emotional needs; finding shelter; and confirming the safety of family, friends, and pets. You may need help figuring out if you have lost or damages possessions such as any your home, auto or other property. Your job may be affected, leaving you without income. You may also need help looking out for scams, price gouging, or consumer fraud.

In the short-term, after a declared disaster, for a week and up to a month, you may need help protecting your shelter & housing rights; recovering lost income & protecting your employment rights; gaining access to federal & state disaster assistance; and maximizing any private insurance options available.

In the long-term, after a declared disaster, from six months and beyond, if you are a homeowner, you may need help understanding housing issues related to your homeowner’s insurance, FEMA assistance, repair/rebuild options, and avoiding foreclosure on your home. If you are a renter, you may need help understanding your options when your residence is damaged, your landlord’s responsibility for repairs of your residence, submitting a renter’s insurance claim, and requesting government assistance for employment and food benefits.

Ultimately, don’t be afraid to get legal advice to assist you with your natural disaster recovery questions. If you follow us on social media, our advocates post resource availability following disasters. Follow us to stay informed!

Home

Home