Credit Reporting

Credit is the ability to borrow money and repay it later. Credit allows you to get the things you need now, like a car or a house, based on your promise to pay over time. When people talk about having “good” or “bad” credit, they’re usually talking about their credit history and scores. Knowing how credit histories, reports and scores can help you take steps towards building (and maintaining) a positive record.

The Fair Credit Reporting Act (FCRA) is related to consumer credit. The FCRA is a federal law that regulates credit reporting agencies. The law compels the agencies to ensure the consumer credit information they gather and distribute is a fair and accurate summary of a consumer’s credit history.

WHAT ARE YOUR RIGHTS?

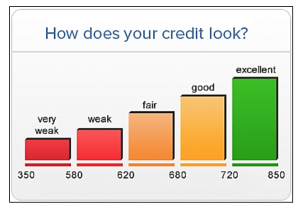

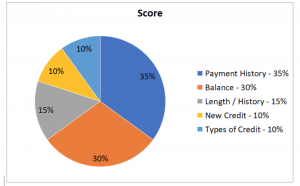

A credit score is a number that helps lenders and others predict how likely you are to pay back a loan on time. Your score is based on your bill-paying history, types of accounts, balances, late payments and age of accounts. Your score ranks you with millions of other consumers to determine how creditworthy you are. The higher your credit score, the less it will cost you to borrow money.

What makes up your credit score is important. If your balances are too high on your credit cards, it could lower your score. Best practice – don’t use more than 30% of your credit limit, unless you plan to pay it off each month.

If you wish to review your score, you may need to pay for it. Scores are not included in some versions of the free credit report, but you will be offered the opportunity to purchase your score from each of the credit reporting agencies. Your score is not necessary to review your credit for mistakes or to have a better understanding of what your “credit history” looks like.

If you apply for a loan, also known as credit, insurance, or employment, they may pull a copy of your credit report.

They are required to tell you if information in your credit file has been used against you. Poor credit scores could make finding affordable car insurance difficult or could even affect whether or not a company offers you a job you have applied for.

Anyone or any company who uses a credit report to deny your application – or to take other adverse action – must inform you. They must give you the name, address, and phone number of the agency that provided them your credit information.

You have the right to dispute incomplete or inaccurate information in your credit file. If you identify information in your file or report that is incomplete or inaccurate, you can report it to a consumer reporting agency. If you report it, the agency must investigate, unless your dispute is determined to be frivolous or fraudulent (unjustified).

If you identify an error on your report, dispute or disagree with that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute. The Consumer Financial Protection Bureau (CFPB) provides instructions and a sample letter template to assist you.

Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information. This happens usually within 30 days. However, a consumer reporting agency may continue to report information it has verified as accurate.

Consumer reporting agencies may not report outdated negative information – in most cases, more than seven years old, or bankruptcies that are more than ten years old.

You have a right to place a “security freeze” on your credit report. A security freeze prohibits a consumer reporting agency from releasing information in your credit file to anyone without your authorization. The security freeze is designed to prevent credit, loans, and services in your name from being approved without your consent.

As an alternative to a security freeze, you have the right to place an initial or extended fraud alert on your credit file at no cost. An initial fraud alert is a one-year alert that is placed on your credit file. Upon seeing a fraud alert display on a consumer’s credit file, a business is required to take steps to verify the consumer’s identity before extending new credit. If you are a victim of identity theft, you are entitled to an extended fraud alert, which is a fraud alert that lasts seven years.

If a consumer reporting agency or an entity who uses your report information violates the Fair Credit Reporting Act (FCRA), you may be able to sue in state or federal court.

For additional information, visit www.consumerfinance.gov/learnmore.

WHAT DO YOU NEED TO DO?

You are entitled to one FREE credit report every 12 months from each of the three main credit bureaus – Equifax, Experian and TransUnion.

Order online at https://www.annualcreditreport.com, the only authorized website for free credit reports, or call 1-877-322-8228. You will need to provide your name, address, social security number, and date of birth to verify your identity.

Order your credit report once a year to check for any inaccuracies or errors.

Dispute or argue against any items on your credit report(s) that are not correct. These disputes are best in writing and sent via certified mail to a consumer reporting agency.

If you believe that someone is attempting to use your credit without your permission, ask the consumer reporting agency to place a “Fraud Alert” in your credit report. An alert makes potential creditors wary of credit applications and inquiries in your name, protecting you from additional fraud. This can be short-term or long-term – from 90 days to 7 years.

Ask the consumer reporting agency to place a “Block” on information resulting from identity theft. When supplied with adequate proof, credit reporting agencies can prevent an identity thief’s actions from appearing on your credit report and negatively affecting your credit score.

WHAT TO CONSIDER BEFORE TAKING ACTION.

Disputes must be made before attempting to file lawsuit.

Disputes should be sent by certified mail if possible.

- Always pay your bills on time.

- Keep your balances low on your credit cards.

- Work to pay off debt instead of moving it around.

- Don’t apply for credit you don’t need. For example, if a store clerk asks you to apply for a credit card to receive a discount off your purchase that day, politely turn them down.

- When shopping for a loan (mortgage or auto) do it in a short period of time.

- Review your credit reports for accuracy at least one time annually.

- Know your credit before you apply for new credit lines (such as a credit card, car loan, or mortgage) and identify the areas you need to improve.

- Beware of fraudulent “credit repair” companies. Housing Counselors at CLSMF can help you understand your credit report and set goals to pay down your debt, increase your credit scores and reach your money goals!

If your credit score is low, it will take some time to repair it.

A CLSMF Housing Counselor can assist you in this process. They can help you order your credit report, guide you through an understanding of what is on it, and assist with disputing errors. They can help to create a plan to increase your credit score.

Call our Helpline at 1-800-405-1417 if you want to make an appointment to speak with a housing counselor at CLSMF.

Home

Home